Why Agile Wealth Partners?

All firms are not created equal... we set out to help you counter the statistics below.

All firms are not created equal... we set out to help you counter the statistics below.

- 80% of business owner's assets are tied up in their business, no liquidity.

- 75% of owners believe they can sell their business in a year or less, it takes 3.

- 58% have never had their business formally appraised, how do you know the value?

- 48% are without any pre-planned exit strategy, strategies need time.

Independent FiduciaryWe've created an environment that allows us to find the best solutions and provide the best advice and we are legally bound to work in your best interest, yes we signed up for this!

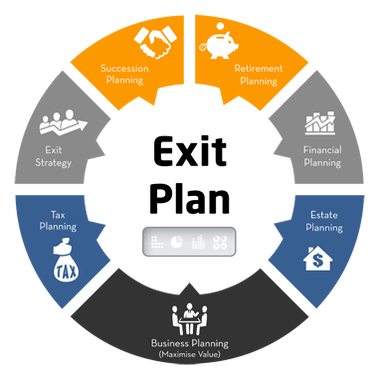

Robust Professional NetworkSubstantial connections to carry out each area of your exit plan, working as a collaborative coordinator and wealth planner to tie everything together. Long-term trustworthy relationships to assure quality.

|

Team BasedWe have made a commitment to Partner with a select group of clients and the entire team assists them on a comprehensive basis by providing Boutique Family Wealth services.

Advanced ExpertiseOur experience, expertise and diverse specialties allow us to bring institutional services to our clients which enhances our ability to offer advanced exit plan strategies.

|

How do you create a win-win transition?

Our experience has shown, the way to go about find your exit number is to do personal wealth planning.

- Reverse engineering your exit plan liquidity event allows you to craft an exit that fulfills your needs.

- Knowing the range of possible outcomes gives flexibility for increased chances of a successful liquidity event.

- Taking this approach allows all parties to be on board and creative advanced strategies to be used.

- Understanding it's what is left after time value of money and taxes is more important than purchase price.

- Having a team in place during this and or after to tie in your personal wealth is the key.

Boutique Business Wealth Services:

Fee based advisor's partnering with business owners transitioning to their next stage of life.

Fee based advisor's partnering with business owners transitioning to their next stage of life.

Our Agile planning approach:

What services are a priority for you and what is the process?

Everyone's needs and situations are different; there are no two clients alike. So we treat you as a unique individual: we listen, we analyze, then together we create simple, clearly defined solutions tailored to your specific needs, so that you too can become financially independent.

Agile Planning is a proprietary collaborative process that breaks down your plan into manageable steps that are continuously updated and monitored. This creates a proactive, flexible, highly communicative environment that allows us to focus on your priorities and puts you in position to be better off when unexpected events and issues arise throughout your journey.

What services are a priority for you and what is the process?

Everyone's needs and situations are different; there are no two clients alike. So we treat you as a unique individual: we listen, we analyze, then together we create simple, clearly defined solutions tailored to your specific needs, so that you too can become financially independent.

Agile Planning is a proprietary collaborative process that breaks down your plan into manageable steps that are continuously updated and monitored. This creates a proactive, flexible, highly communicative environment that allows us to focus on your priorities and puts you in position to be better off when unexpected events and issues arise throughout your journey.

Take the First Step...

Trustworthy established partners and service providers we rely on for the best client experience:

Investment advisory services performed by Agile Wealth LLC. a registered investment adviser in the state of Michigan. The adviser may transact

business in states where it is appropriately registered, or where it is excluded or exempted from registration. Information presented is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are

not guaranteed. Be sure to consult with a qualified financial adviser or a tax professional before implementing any strategy discussed herein.

business in states where it is appropriately registered, or where it is excluded or exempted from registration. Information presented is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are

not guaranteed. Be sure to consult with a qualified financial adviser or a tax professional before implementing any strategy discussed herein.

SCHWAB CLIENT LOGIN |

CONTACT

|