Why Agile Wealth Partners?

All firms are not created equal...

Independent FIDUCIARY

DEDICATED TEAM

ADVANCED Asset EXPERTISE

Our Agile Investment approach:

- Evidence based.

- Tactical Strategy

- Continuous search for opportunities.

Agility is the ability to change position rapidly and accurately without losing balance.

How do we maintain balance? Everyone's needs and situations are different; there are no two clients alike. So we treat you as a unique individual: we listen, we analyze, then together we create simple, clearly defined solutions tailored to your specific needs, so that you can become financially independent.

Agile planning is a proprietary collaborative process called The Agile Wealth Plan...

This process breaks down your plan into manageable steps that are continuously updated and monitored. This creates a proactive, flexible, highly communicative environment that allows us to focus on your priorities and puts you in position to be better off when unexpected events and issues arise throughout your journey.

Agile planning is a proprietary collaborative process called The Agile Wealth Plan...

This process breaks down your plan into manageable steps that are continuously updated and monitored. This creates a proactive, flexible, highly communicative environment that allows us to focus on your priorities and puts you in position to be better off when unexpected events and issues arise throughout your journey.

Boutique Family Wealth Services:

Fee based advisors partnering with clients transitioning to their next chapter in life.

Fee based advisors partnering with clients transitioning to their next chapter in life.

Trustworthy established partners and service providers we rely on for the best client experience:

Why should Financial Independence be the goal?

Financial independence is when your resources and mindset align allowing you true comfort and choice. Knowing you are on track to meet your long term goals allows you the ability to experience and pursue things such as starting your own business, traveling the world, exploring a passion of yours , creating a charity, and increasing time with family and friends.

The difference between Independence and retirement is significant. Independence means you have the freedom to choose how you live your retirement. That doesn't just mean stability during the latter years of life, it means choice, clarity, and control. This is our goal for you.

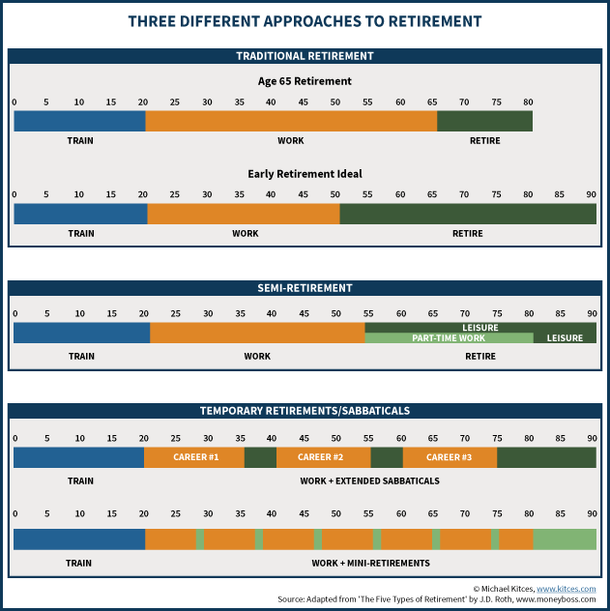

"Retirement" is changing...

Financial independence is when your resources and mindset align allowing you true comfort and choice. Knowing you are on track to meet your long term goals allows you the ability to experience and pursue things such as starting your own business, traveling the world, exploring a passion of yours , creating a charity, and increasing time with family and friends.

The difference between Independence and retirement is significant. Independence means you have the freedom to choose how you live your retirement. That doesn't just mean stability during the latter years of life, it means choice, clarity, and control. This is our goal for you.

"Retirement" is changing...

Investment advisory services performed by Agile Wealth LLC. a registered investment adviser in the state of Michigan. The adviser may transact

business in states where it is appropriately registered, or where it is excluded or exempted from registration. Information presented is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are

not guaranteed. Be sure to consult with a qualified financial adviser or a tax professional before implementing any strategy discussed herein.

business in states where it is appropriately registered, or where it is excluded or exempted from registration. Information presented is for educational purposes only and is not an offer or solicitation for the sale or purchase of any securities or investment advisory services. Investments involve risk and are

not guaranteed. Be sure to consult with a qualified financial adviser or a tax professional before implementing any strategy discussed herein.