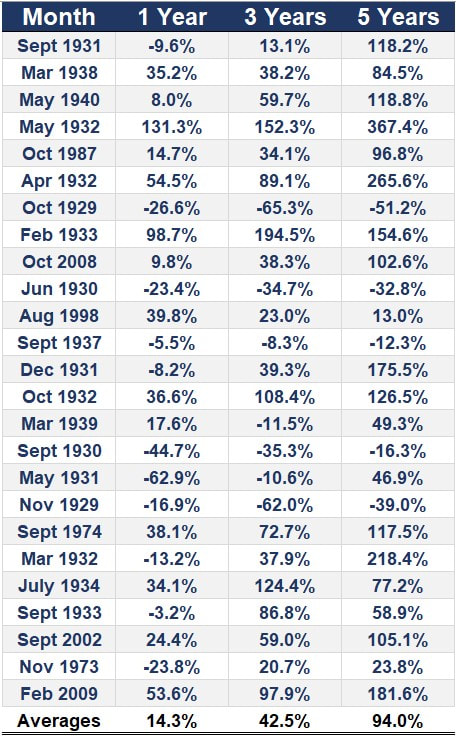

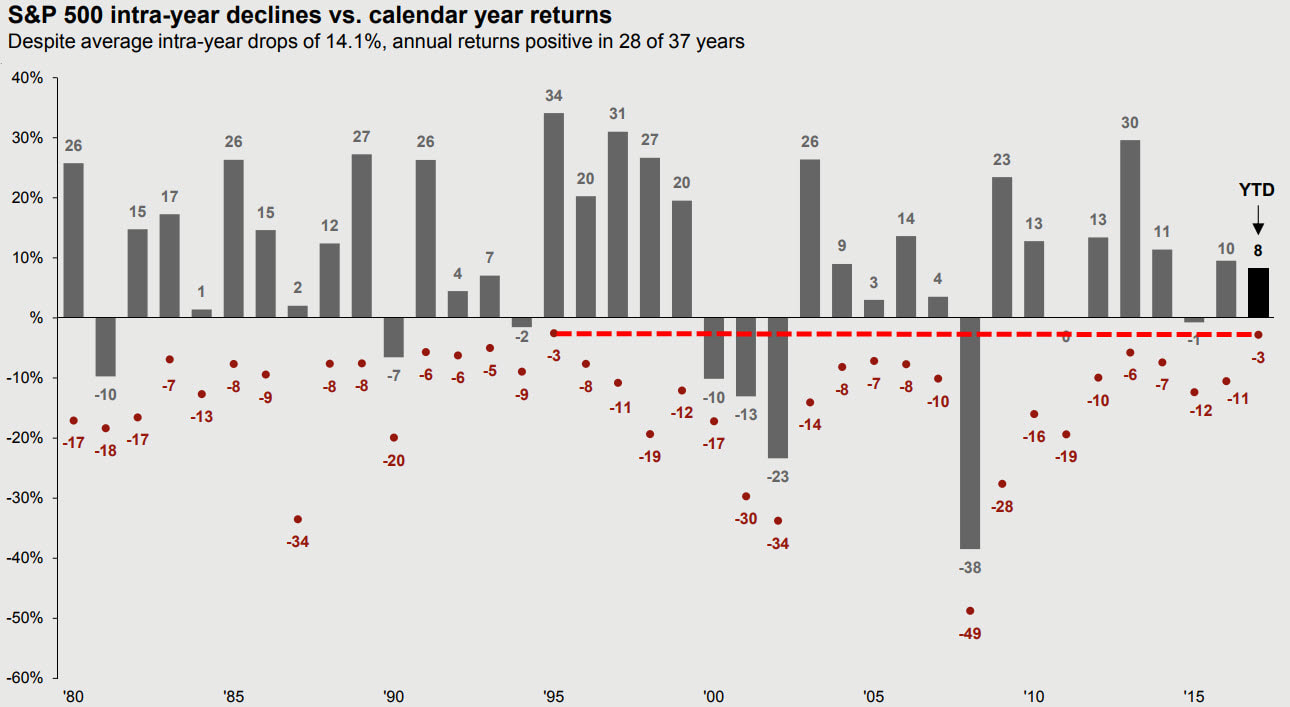

I'm think you're probably saying... yes John I care what should I do!? Ultimately I care, of course, at the same time however I am truly looking at this as a long term opportunity than a long term crisis. I am not completely comfortable on how this will all end nor do I care to predict as I said in my last piece, Bonds at all-time highs, however, history has shown 20%+ sell offs are rare and 30% drops are even rarer. Here is a chart that shows the draw-downs we have experienced and the ending market return for that year. The key here is to see that there are not many market drops over 20% and when there are it is often an opportunity at some point around that drop. Another takeaway market drops are not substantial until they hit 12%. We have to look out a bit to when the Coronavirus slows and we feel we have good control over things, more importantly, the travel and business that continues to get canceled is no longer being canceled. At that time we will be sitting on free money, 10yr bond under .50%, cheap energy as oil is selling off as well, and fair market valuations. Sure all this may need some time to get sorted out but in the meantime work with your advisor or shoot me a call/email to take a second look because if we approach this correctly there is a huge opportunity here. If you are in the first few years of your retirement please seek advice as that would be the time frame which I am the most concerned. As you can see below, we often are higher after sell-offs like these. Below highlights months where we experienced the largest sell-offs and the subsequent return after in 1, 3 and 5 years. (bottom) As we can see time is the key factor here, so in the meantime, we should be doing a few things in our financial plans.

Be well, John

0 Comments

|

The Agile Investor is a blog that focuses on being prepared and informed within various topics of wealth management, investments, financial markets and investor psychology. Enjoy Archives

May 2022

Categories |

Proudly powered by Weebly