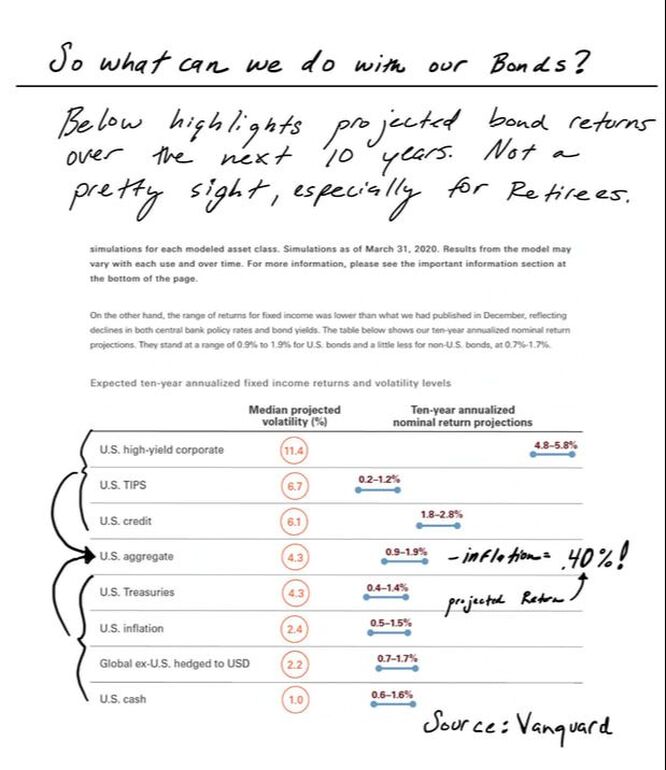

So what can we do with our bonds?I wanted to share some notes that I wrote on about the perplexing nature of bonds. Depending on your age you most likely to have little to no bonds in growth stages of life and increasing amounts as you approach retirement. Please understand this is not a recommendation to sell all or any of your bonds without some thought and investigation. Note on 1. There are some areas in the fixed income bond arena we feel comfortable with and will squeak out some gains or at least hold value but not sure that is a solution for all of your fixed assets and they need to be monitored. Two final points, I have ran into some pre retirees with less than say 5 years to retirement over the last several months who had almost 90% in. stocks, it has worked out as we really lucked out again rising back so fast, but if you haven't tactically managed this and you just let it ride up until now consider some of these items below as an alternative to your portfolio. Finally all this can only make sense and come together if you are doing comprehensive planning and making sure everything is working together if not please do not attempt to randomly add one of the items below and think it will just fit. Text version below... So what can we do with our bonds?

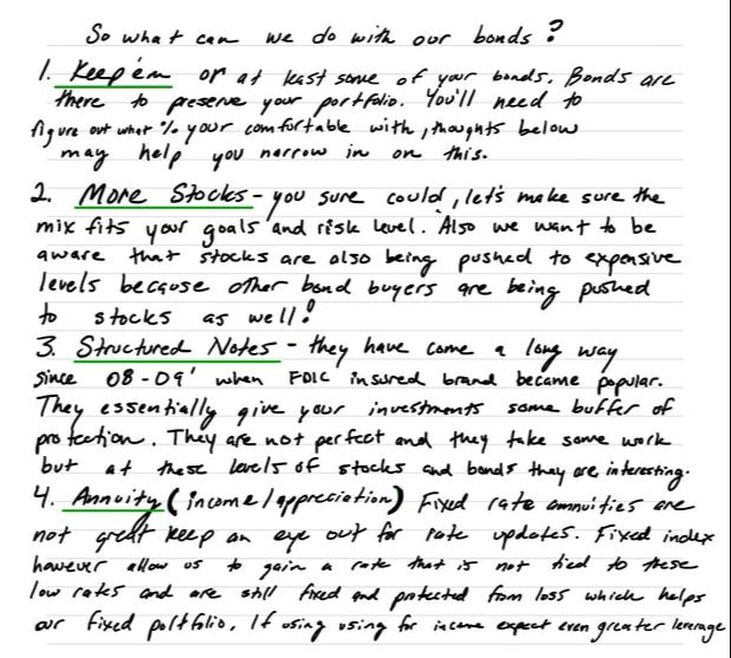

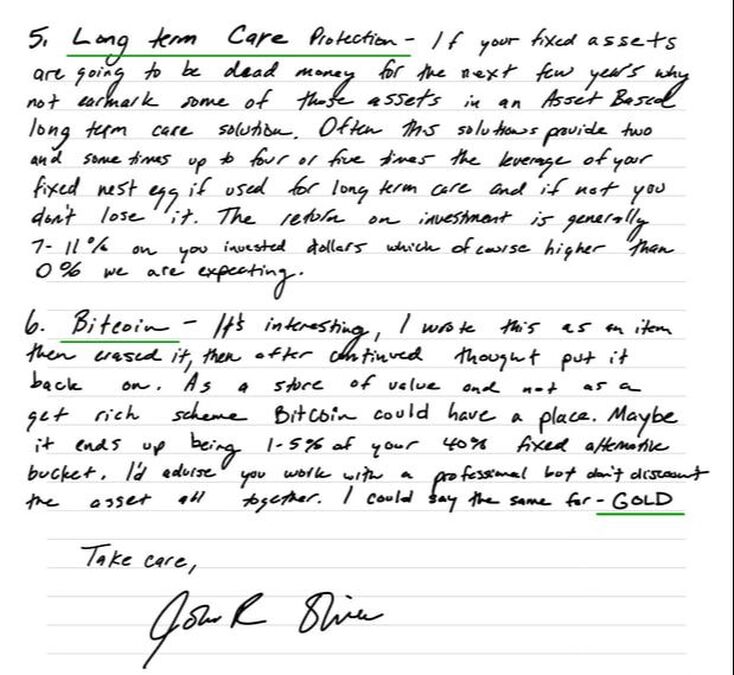

I. Keep 'em... at least some of your bonds. Bonds are there to preserve your portfolio. You'll need to figure out what % your comfortable holding, thoughts below may help you narrow in on this. 2. More Stocks-you sure could buy more stocks, let's make sure the mix fits your goals and risk level. Also we want to be aware that stocks are being pushed to expensive levels because other bond buyers are being pushed to stocks as well. Always interesting nooks to be exposed however. 3. Structured Notes-they have come a long way since 08-09' when FDIC insured brand became popular. They essentially give your investments some buffer of protection to the downside and have limitations to upside. They are not perfect and they take some work but at these levels of stocks and bonds they are, interesting. 4. Annuity - Income or appreciation contracts. Fixed rate annuities are not great but keep an eye out for rate updates sometimes companies make decent offers. Fixed index however allow us to participate in gains that is not tied to current low rates and are still fixed/ protected from loss which helps our fixed portfolio. If using using for income expect even greater leverage 5, Long term care Protection- If your fixed assets are going to be dead money for the next few years why not earmark some of those assets in an Asset Based long term care solution. Often this solutions provides two and sometimes up to four or five times the leverage of your fixed nest egg if used for long term care and if not use you don't lose it. The return on investment is generally 7- 11% on you invested dollars which of course higher than we are expecting. 6. Bitcoin- It's interesting, I wrote this as an item then erased it, then after continued thought put it back on. As a store of value and not as a get rich scheme Bitcoin could have a place. Maybe it ends up being l-5% of your 40% fixed bucket. I'd advise you work with a professional but don't discount bitcoin all together. I could say the same for-Gold

1 Comment

96% of Social Security claimants fail to make the optimal claiming decision. That means they lose out on an estimated $3.4 trillion in potential retirement income ($111,000 per household) because they don’t choose the option that maximizes their income.

That’s why it’s so important to get the most accurate and up-to-date information, assess your personal situation properly, and file for Social Security the right way (and at the right time). https://unitedincome.capitalone.com/library/the-retirement-solution-hiding-in-plain-sight 4 Things You Might Not Know About Social Security (1) Your Social Security Benefits may be taxed... https://docs.google.com/presentation/d/14NetqQnHjnuwhaQNBJrSNxofIL8Nfwz5653Xb-SJ-EU/edit#slide=id.p22 (2) You may be able to claim at age 62 on your own SS and switch to spousal benefits later to receive a higher benefit. https://www.aarp.org/retirement/social-security/questions-answers/switch-social-security-spousal/ (3) You can suspend SS benefits and restart them at a higher value later. Maybe you find yourself starting a business or consulting part-time. https://www.aarp.org/retirement/social-security/questions-answers/suspend-social-security-then-restart/ (4) You can use Delayed Retirement Credits to maximize your benefits. For every month from your FRA until age 70 that you postpone filing for benefits, Social Security increases your eventual benefit by two-thirds of 1 percent — a total of 8 percent for each year you wait. For example, wage earners who reach full retirement age at 67 but delay claiming benefits until 70 will get an extra 24 percent tacked on to their monthly payment. https://www.aarp.org/retirement/social-security/questions-answers/delayed-retirement-credits/ (5) BONUS: You may be able to collect SS as a divorced spouse and then wait to claim on your own work history. You can file what Social Security calls a “restricted application” to claim only ex-spousal benefits and postpone claiming your retirement benefits if: You were born before Jan. 2, 1954. You have reached full retirement age (currently 66, gradually rising to 67 over the next several years). You were married for at least 10 years to your former spouse. You are currently unmarried. Your former spouse has filed for his or her own Social Security benefits or your ex-spouse is at least 62 and you have been divorced at least two years. https://www.aarp.org/retirement/social-security/questions-answers/claim-divorced-spouse-benefit/ WHAT SHOULD YOU DO NEXT? Create your own online SS account https://www.ssa.gov/site/signin/en/ REQUEST Free No Obligation SS Planning Tool OTHER ARTICLES/RESOURCES Thinking of retiring? https://www.ssa.gov/osss/prd/pdf/en/55-plus-insert.pdf COLA raise likely for 2021 -- Kiplinger forecasting 1.2% https://www.kiplinger.com/retirement/social-security/601286/2021-cola-a-raise-likely-for-social-security-recipients-after-all?rid=EML-retire&rmrecid=4628004169&utm_campaign=20200902-retire&utm_medium=email&utm_source=retire Steve Livingway |

The Agile Investor is a blog that focuses on being prepared and informed within various topics of wealth management, investments, financial markets and investor psychology. Enjoy Archives

May 2022

Categories |

Proudly powered by Weebly