|

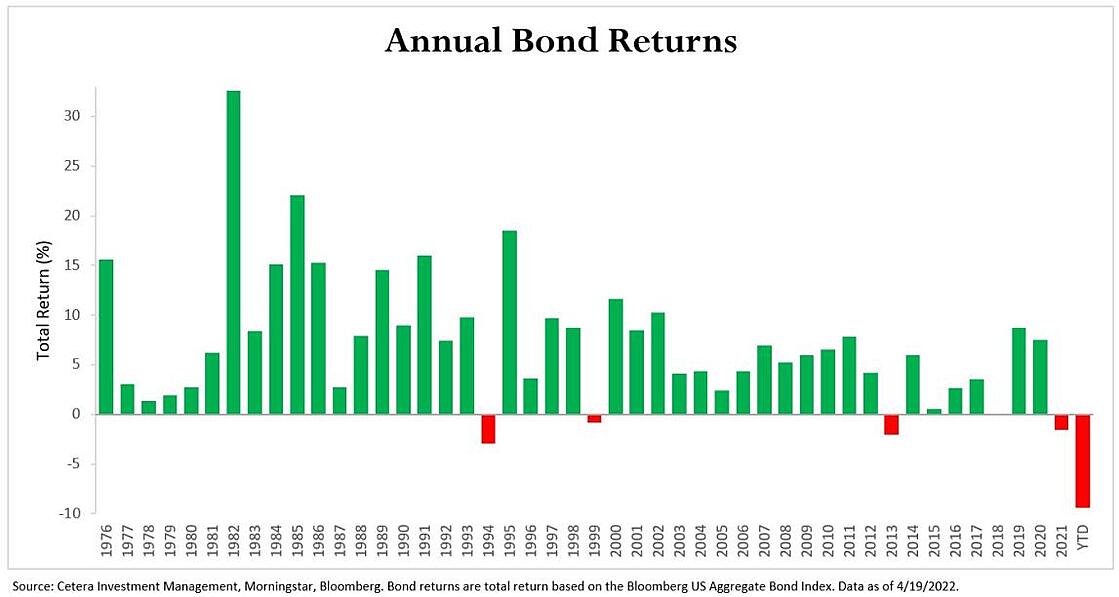

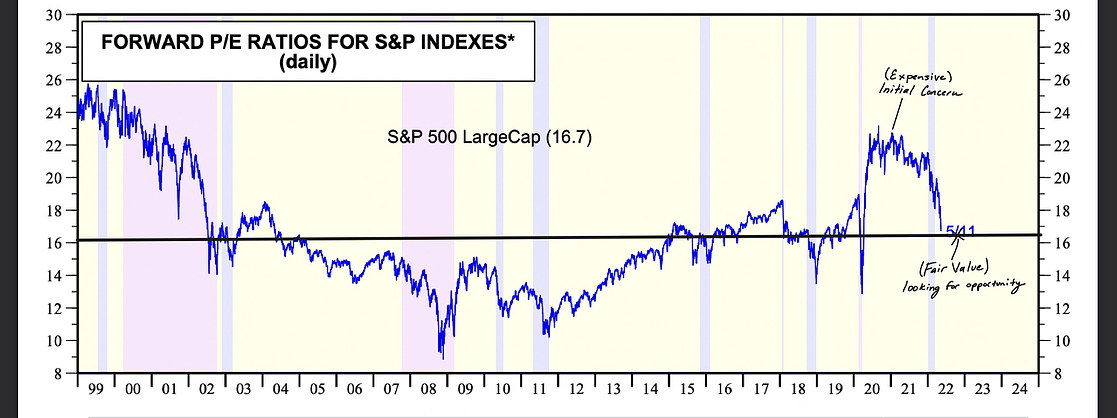

The following is an update and continuation of the notes we sent in March (link). If you could not read our previous message, take a look as it gives context to the notes mentioned below. Market Environment As we track the markets closely, the environment is uncertain and has created an uneasy feeling amongst investors. Investors are currently experiencing one of the most challenging environments ever. There haven't been many hiding places, as bonds have finally sold off in line with stocks. A diversified portfolio has had its challenges as emerging markets stocks are down -23%, International -18%, Aggregate Bonds at -12%, and growth-oriented stocks, i.e., Nasdaq 100, down -25%. As you can see below from the charts, the bond market has been on pace for the worst year in history. Bonds have done little to help as they are used for income and protection from volatility. Neither is being achieved. They are historically on sale, but we do not expect any outperformance compared to stocks and inflation. Valuations: Are stocks finally cheap? Our initial concerns highlighted (see chart below) that stocks were frothy and offered limited upside to future growth, mid-2021. When valuations are at that level, an investor can expect muted returns of 3 to 4% from stocks. After the 20% drop, we are now closer to historical return projections of 6-7%. Using valuation data and other factors allows us to make prudent moves to protect wealth for clients as the risk-reward scenario was not in our favor, noted below around 23 and is more favorable now around 16. Management: What have we been doing?

At Agile, we have done a particularly good job reducing our stock exposure as we started the process over a year ago. We have had cash levels between 20 to 35% for clients and weathered the inflationary environment with investments in materials and energy. The team continually adjusts to long-term goals and the market environment, being agile. Our investment mix has allowed us not to feel the entirety of the market dip. We are in a great position in the future as we have the cash to deploy at better prices. We have increased the quality of our current holdings and have strategically favored high-caliber dividend growth companies for our core holdings. Opportunity? Short-term uncertainty creates long-term opportunities. We have set ourselves up to take advantage and are cautiously optimistic. Volatility could linger longer than we would like as we are not expecting a pandemic V-shaped comeback. We welcome current market valuations as they are back to fair historical levels (chart above). We are now combing through and looking for outstanding companies that are cheaper than the market, which will provide us with high-quality long term holdings. The brunt of the market has unfairly taken down these companies with it. Our job is to patiently recognize these and take advantage of these opportunities even as many feel uncertain about the future, using our research and experience to create clarity. As said in March, these are the times that make a difference in long-term wealth creation. Balancing our way through this diligently with a careful hand will set us up for success as we keep you on track to your journey of Independence. Agile Wealth Team

1 Comment

|

The Agile Investor is a blog that focuses on being prepared and informed within various topics of wealth management, investments, financial markets and investor psychology. Enjoy Archives

May 2022

Categories |

Proudly powered by Weebly