|

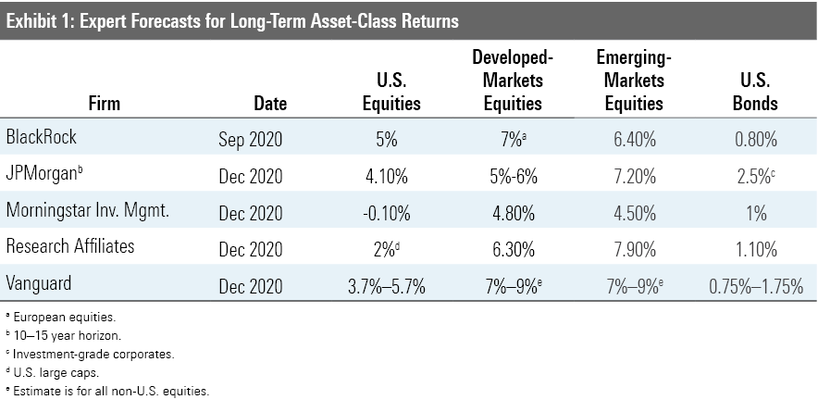

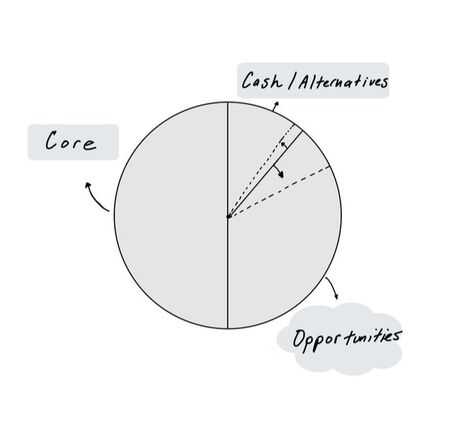

There has been a lot of investment chatter, (Stocks/bonds, Cryptocurrency, SPACs, Inflation) over the last few months as stimulus plans, presidential changes, and the pandemic has created an interesting environment, unlike any other in the past. Below I review my insights on the current climate within the basis of our investment philosophy, some action steps that can help make all this "stuff" matter, and a way to take advantage. STOCKS & BONDS Let's start with a broad look at stock and bond market expectations over the next decade. Some of the top firms did their analysis, and the results are below (updates have looked worse). We could find ten charts that show stocks are overvalued and like a swinging pendulum, need to come back to equilibrium, they always do. Understandably, as the last decade has been exceptional, you should have done well. As overvalued as stocks are, they are a good hedge against the upcoming inflation we are starting to feel, while bonds are more overvalued than stocks on a relative basis. What does this mean for your wealth? If you are using anything over 5% total return before inflation, you may be setting yourself up for some unrealistic expectations. (More on this below) We are at a high risk low reward position on our pendulum; that being said no one can predict what happens from here. How does using a traditional 60% stock, 40% bond portfolio that pre-retirees are often suggested affecting your returns? If your bond portfolio is up 1.75% (the high side) over the next ten years, then what do your stocks need to increase to get a reasonable return? You will have to earn over 8% on your stocks plus an optimistic 1.75% on your fixed portfolio to keep up with your 5% benchmark. Subtract inflation, and your return is now in the 2.5 to 3% range. Let's discuss inflation. INFLATION Multiple factors such as worker shortage, supply shortages then sprinkle on about 8 trillion dollars of liquidity, and we have created a supply and demand mismatch. This supply shortage has created inflated prices on things people want, from cars (metal) to homes (wood). Additionally, poor logistics and high delivery demand within many industries inflate other commonly needed items such as fuel and food. Considering, I still think we can find an equilibrium and weather some of this inflation, we need to be sure that it doesn't spike too fast and investors don't think that the fed doesn't have a good handle on it. Remember, if factors act in unison, employment, wage increases, price increases, then interest rates will need to rise, which will be a sign of health. Some sectors will have a hard time during this period, while others will thrive. Inflated prices can make wealth disappear so be aware and be careful. We still need to meet our goals even if conditions have changed, what can we do? Having a long-term view, an investment plan, the appropriate asset allocation, and a consistent savings program are great things that are needed for success. However, we are currently in an inflated asset price environment. So, does it make sense to do the same thing, or do we adjust accordingly? Model Allocation funds most likely miss the boat here. Suppose projected equity expectations over the next ten years of 5% are true, and you hold a traditional diversified portfolio. In that case, you will miss many strong intra-market trends that take place within markets beyond the traditional asset mix. There are ways you can alter your approach to take advantage of these new trends. An Agile Approach Here are some solutions to keep you engaged and give you a better risk-reward scenario while keeping downside and preservation a focus. CORE Use evidence-based long-term investing in creating a core investment bucket, distinguishing an amount by measuring your risk level and your investment time frame (based on a financial plan). This portion is monitored and managed for investment style, cost, and tax efficiency. The Core portion should not include any short-term cash buckets or fixed income/cash alternatives, just your growth-oriented assets. The asset class mix is consistently upgraded, and it's opportunistically rebalanced based on market rules. The Core will allow you to use investing principles to simplify a portion of your investment plan. To complete the Agile process, you now add your flexible portion of your portfolio, cash/cash alternatives, and opportunities. ALTERNATIVES I've discussed alternatives quite often in the last 12-24 months as bonds have been unfavorable (Bond Alternatives post) , but you still need a preservation bucket in your portfolio. As I mentioned in my post last year, there is a case for a wide array of choices. A few more have entered the arena, namely Special Purpose Acquisition funds, additional choices in the downside protected vehicles, expansion of the crypto world, and another that I will highlight at the end that we just purchased for our clients. Cash and Cash Alternative bucket will be the holding tank for assets to flow into, for example when you rebalance your Core, trim, sell opportunities (more on this in a minute). These assets should not just sit, nor do we NEED to put them in bonds as traditionally thought in the past. Be clever here and look for ideas that have some preservation and safety in mind but still offer some upside potential. Opportunities Opportunities will always exist in markets across all assets. For as efficient as the general market is, if you're curious enough, patient, and willing to work, you can find a disconnect for asset prices and take advantage. It helps if you think of this as an expression of 10-15 drivers (theme, inefficiencies, trends) with 1 or 2 ideas per, resulting in 15 to 20 holdings within the opportunities bucket. Market assets change every minute; no one said you need to be invested in them 100% of the time. Allow yourself the ability to take advantage of fat pitches from time to time while preserving your assets at other times as they sit in your cash alternatives bucket. If we invest in this manner we are investing with the intention of fulfilling these ideas/themes/drivers rather than just filling up the traditional 60/40, 70/30 model. We have introduced competition for our money in which only the best risk reward and asymmetric investments are represented, no more average, no more settling because we think TIME will save us. Does this sound more appealing than the traditional approach? Why is it hard to to do or find someone who can? HARD WORK AND DISCIPLINE It’s hard, it takes hard work and it is often only performed by the ultra wealthy and their teams or those who have the time and discipline to accomplish it, commonly a professional individual trader. Average results come from average strategies, curiosity and persistence need not apply. Most importantly, It takes diligence and emotional stability, it’s one the hardest things to do, some people can, most can't. Emotional discipline... and why is CASH not always bad? When you are managing your investments with discipline, rebalancing, upgrading, trimming and selling cash can quickly build. Why is cash so important to this equation? A hedge is a tool that allows you to preserve your nest egg or counter your risk with the opposite effect of the market. Your cash becomes a Hedge. Generally when you own cash you are hedging against market environments, you are now removed from the market with that portion of money. Cash is emotionless, it has no name, it’s not a brand, or a grand idea, it has no ties and for that cash as they say is king. Over long periods of time cash or cash like fixed holdings can be a poor investment but when it comes to a tactical strategy, cash is a great tool. It allows you to wait on the fat pitch as you are then ready to implement at a moment's notice. It always helps us to be agile when an opportunity comes, we can't predict the future so we wait patiently and ready. So cash is truly the opposite of the market which are controlled by people, their fear and their greed. ACTION

Why can't most people act if we know things are changing and knowing there is an opportunistic agile alternative? As human beings we often wait for the perfect opportunity; downplay the our risk and pressured to follow the herd. It's hard to act. It's hard to gain conviction on what can set us up for success when media and others around us seem to all be on the same path, a path that leads to the status quo. It takes courage and curiosity to think outside the box. We see the best investors do not do what the majority do; they are concentrated in their best ideas, love cash, and their diversification is much different from the rest. We should take note, listen, learn, and do something to make that difference rather than talk and think about it. Create a plan, understand why you're doing what you're doing, and get to work on it. So the next time someone tells you to buy and hold, think a bit about all the factors involved. It's because most of us don't have the patience, curiosity, and willingness to work hard to gain the advantages that present themselves from time to time. It is possible however, You can do it or find a partner who can. - John R. Oliver **Portfolio Investment Update, firm cash alternative bucket. Please understand this is not a direct recommendation as I do not know your current situation, informational purposes only. Many fixed alternatives in themselves could be traded or held for many years and need monitoring. iVol is an innovative fixed income tool; they use their options expertise to create an ideal risk-reward profile that allows investors to get an above-average distribution and protect themselves against credit market volatility and sequentially inflation. No one can predict whether we continue to see inflation lead to higher interest rates. Still, with rates being at 30-year lows, the asymmetric scenario created by this fund allows us to take advantage of a trend reversal that is sure to happen over the next several years. As with anything, if we are unsatisfied or they change the approach, we will not hesitate to eliminate it; for now, we are pleased with this alternative for traditional fixed asset alternative. This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

0 Comments

Leave a Reply. |

The Agile Investor is a blog that focuses on being prepared and informed within various topics of wealth management, investments, financial markets and investor psychology. Enjoy Archives

May 2022

Categories |

Proudly powered by Weebly