|

Fear and greed will never leave the Stock Market equation. This time is no different. The extreme greed we experienced over the last 36 months is now being met with factors causing volatility (radical market movement) to raise its head once again. We wanted to chime in to show you the broad steps we take in environments like this and how it helps calm the waters and ultimately creates significant opportunities for us in the intermediate term. I'll also reference the blog post I wrote about one year ago... HERE when we started to enter a stealth-like market correction, low-quality stocks began making their way down, many finished flat for the entire year losing their gains. As the blog points out, our management philosophy doesn't waiver in good or bad markets. We manage around a core set of assets that keep us generally invested for the long run—leaving us with a portion for high conviction stocks, opportunities, and the cash alternative bucket. So how do we approach market dips? When the market calculates as expensive historically (think of a rubber band as it stretches to high. It always comes back to equilibrium. Once it's stretched one way or another, it makes its way back to the center), we adjust portfolios to high quality and lower overall risk stature. We did that throughout last year. We take the following steps to preserve and prepare for opportunities as the market starts to breakdown and trend down.

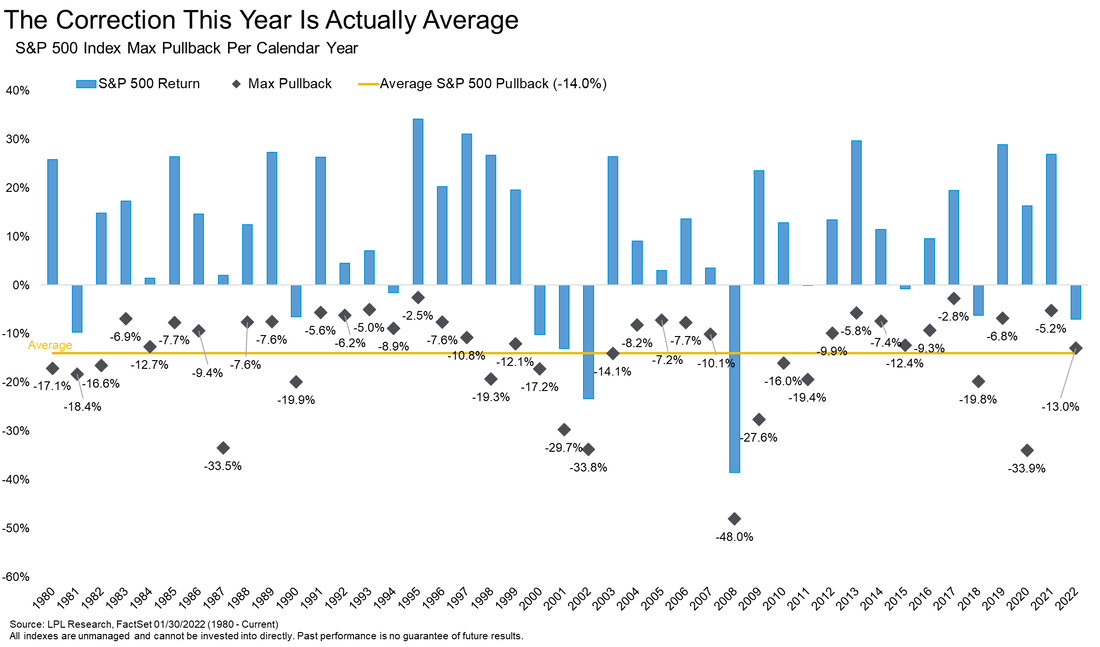

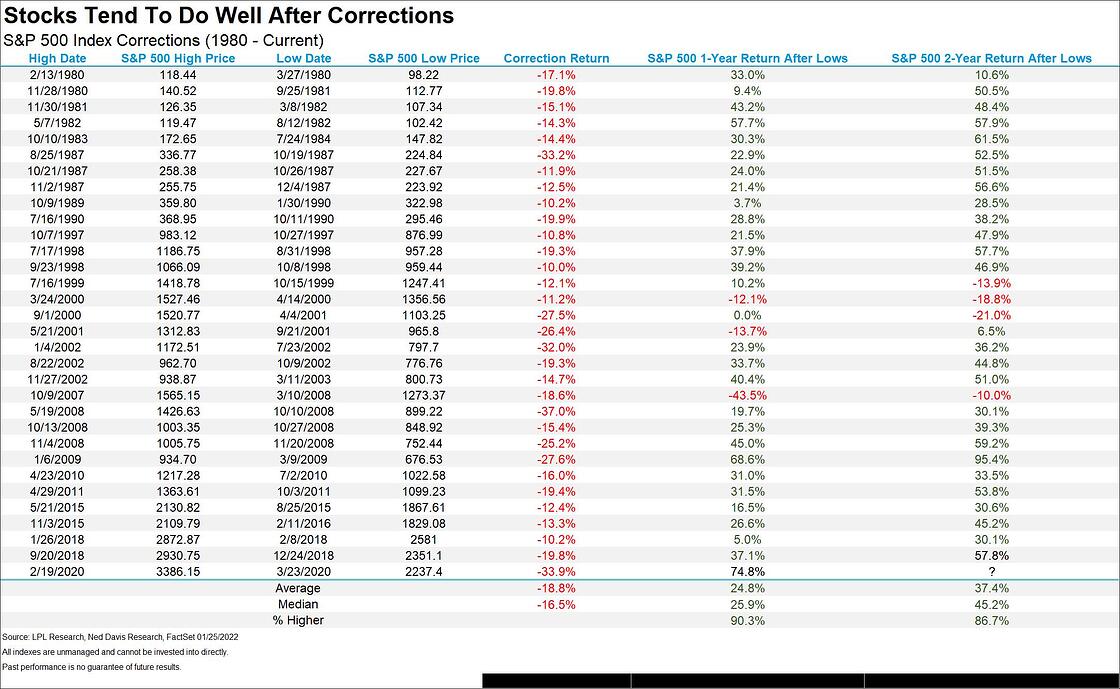

This process is not a perfect science; it takes many years of market experience to handle this type of management. Although the outline of steps is there, the actual test is the behavioral portion of the activity. Understanding the rubber band equilibrium and consistently looking for opportunities helps. Every dollar of cash or protected assets becomes tremendously valuable. If that dollar only went down 7% and is used to buy an investment that went down 40%, you can experience upside leverage. If that stock goes down 40% and it revisits the high price over the next few years, it will have an overall gain of 67%: same company, same price just after a dip. Dips are common and help the market seek higher levels as prices can not just rise straight up. Generally each year brings on a dip of around 5-14%, and every 3-4 years, we get one between 15-20%. Significant drops are less likely but occur every seven or so years but are still random. These are the times when we make our long-term gains, buying entry points that show a much lower risk, much higher reward as the rubber band is stretched too low and needs to come back to center. The band always will, and in between, we will take advantage of the fear that pushes things too low and the greed that stretches things too high to give you an edge. See chart below, as it shows how the rubber band snaps back well after being pulled down. We are tracking this market very closely; we are in an excellent position, and opportunities are starting to become more attractive, but there may be more to fall before they look great. We are patient, continuously reducing risks as we break and waiting for suitable entries into great investments that only come every handful of years.

John R. Oliver- Director of Asset Management

0 Comments

Leave a Reply. |

The Agile Investor is a blog that focuses on being prepared and informed within various topics of wealth management, investments, financial markets and investor psychology. Enjoy Archives

May 2022

Categories |

Proudly powered by Weebly