|

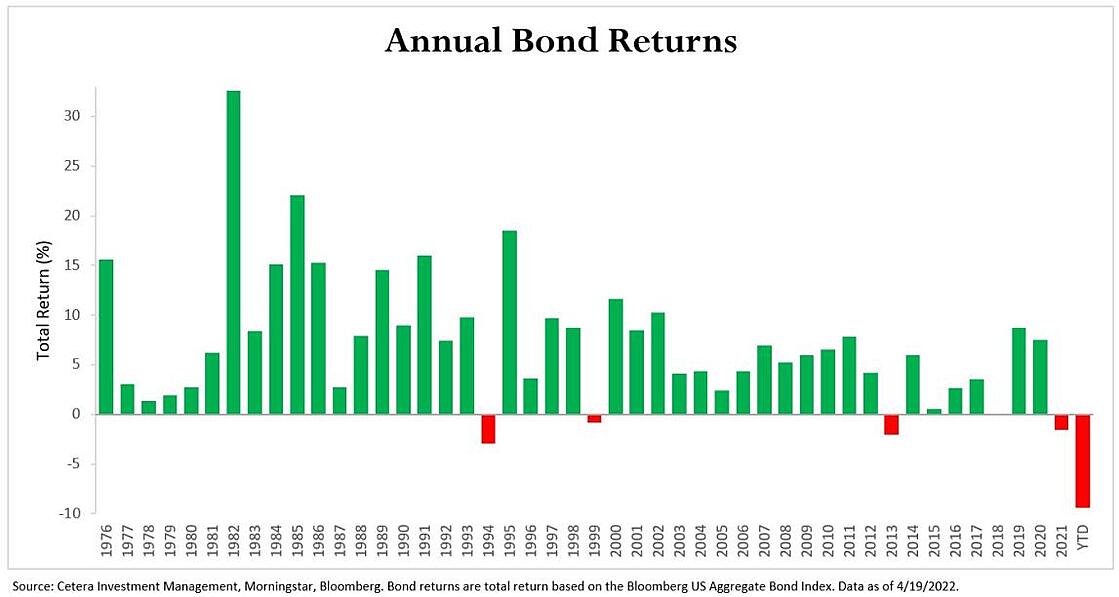

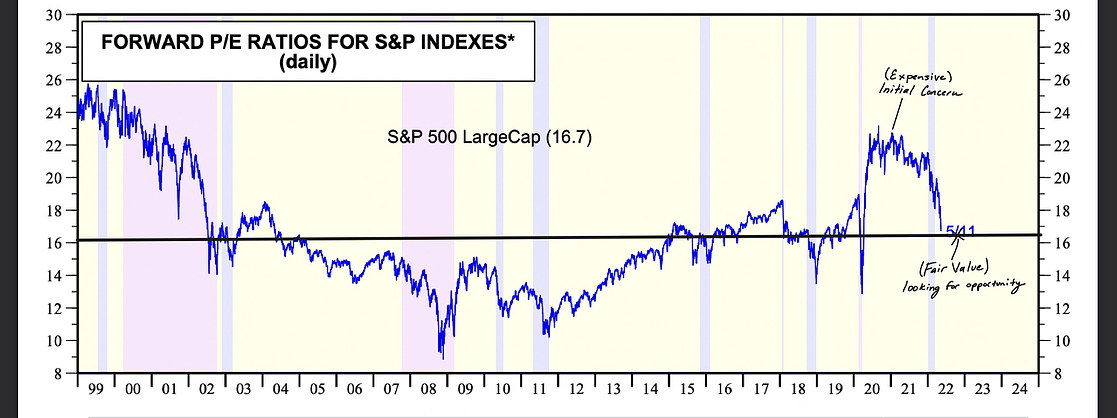

The following is an update and continuation of the notes we sent in March (link). If you could not read our previous message, take a look as it gives context to the notes mentioned below. Market Environment As we track the markets closely, the environment is uncertain and has created an uneasy feeling amongst investors. Investors are currently experiencing one of the most challenging environments ever. There haven't been many hiding places, as bonds have finally sold off in line with stocks. A diversified portfolio has had its challenges as emerging markets stocks are down -23%, International -18%, Aggregate Bonds at -12%, and growth-oriented stocks, i.e., Nasdaq 100, down -25%. As you can see below from the charts, the bond market has been on pace for the worst year in history. Bonds have done little to help as they are used for income and protection from volatility. Neither is being achieved. They are historically on sale, but we do not expect any outperformance compared to stocks and inflation. Valuations: Are stocks finally cheap? Our initial concerns highlighted (see chart below) that stocks were frothy and offered limited upside to future growth, mid-2021. When valuations are at that level, an investor can expect muted returns of 3 to 4% from stocks. After the 20% drop, we are now closer to historical return projections of 6-7%. Using valuation data and other factors allows us to make prudent moves to protect wealth for clients as the risk-reward scenario was not in our favor, noted below around 23 and is more favorable now around 16. Management: What have we been doing?

At Agile, we have done a particularly good job reducing our stock exposure as we started the process over a year ago. We have had cash levels between 20 to 35% for clients and weathered the inflationary environment with investments in materials and energy. The team continually adjusts to long-term goals and the market environment, being agile. Our investment mix has allowed us not to feel the entirety of the market dip. We are in a great position in the future as we have the cash to deploy at better prices. We have increased the quality of our current holdings and have strategically favored high-caliber dividend growth companies for our core holdings. Opportunity? Short-term uncertainty creates long-term opportunities. We have set ourselves up to take advantage and are cautiously optimistic. Volatility could linger longer than we would like as we are not expecting a pandemic V-shaped comeback. We welcome current market valuations as they are back to fair historical levels (chart above). We are now combing through and looking for outstanding companies that are cheaper than the market, which will provide us with high-quality long term holdings. The brunt of the market has unfairly taken down these companies with it. Our job is to patiently recognize these and take advantage of these opportunities even as many feel uncertain about the future, using our research and experience to create clarity. As said in March, these are the times that make a difference in long-term wealth creation. Balancing our way through this diligently with a careful hand will set us up for success as we keep you on track to your journey of Independence. Agile Wealth Team

1 Comment

Fear and greed will never leave the Stock Market equation. This time is no different. The extreme greed we experienced over the last 36 months is now being met with factors causing volatility (radical market movement) to raise its head once again. We wanted to chime in to show you the broad steps we take in environments like this and how it helps calm the waters and ultimately creates significant opportunities for us in the intermediate term. I'll also reference the blog post I wrote about one year ago... HERE when we started to enter a stealth-like market correction, low-quality stocks began making their way down, many finished flat for the entire year losing their gains. As the blog points out, our management philosophy doesn't waiver in good or bad markets. We manage around a core set of assets that keep us generally invested for the long run—leaving us with a portion for high conviction stocks, opportunities, and the cash alternative bucket. So how do we approach market dips? When the market calculates as expensive historically (think of a rubber band as it stretches to high. It always comes back to equilibrium. Once it's stretched one way or another, it makes its way back to the center), we adjust portfolios to high quality and lower overall risk stature. We did that throughout last year. We take the following steps to preserve and prepare for opportunities as the market starts to breakdown and trend down.

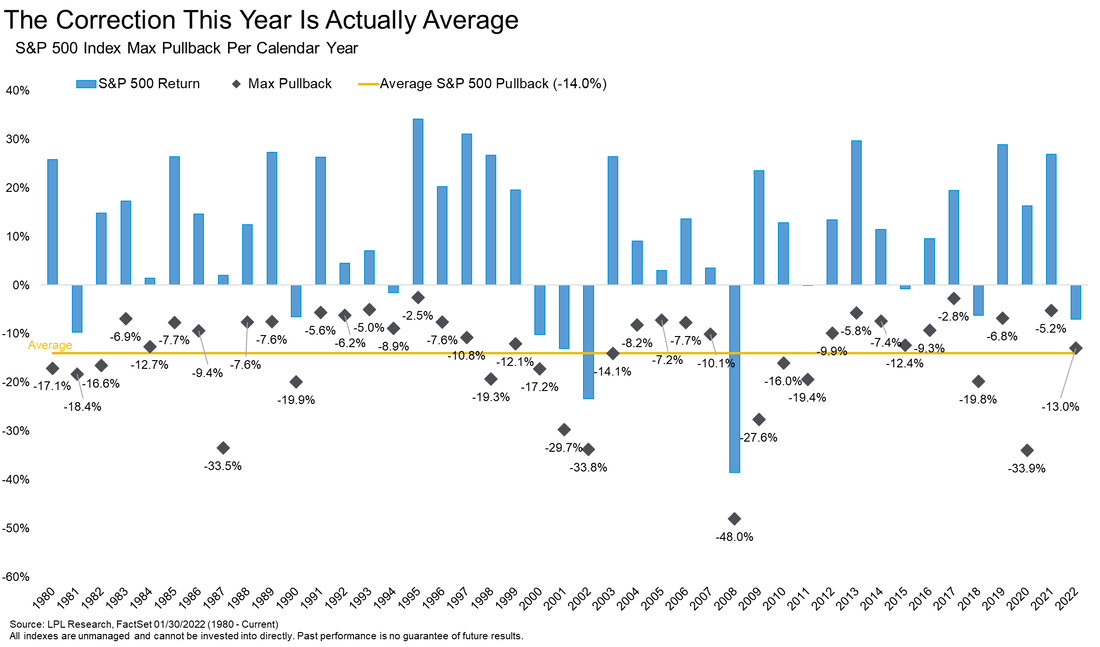

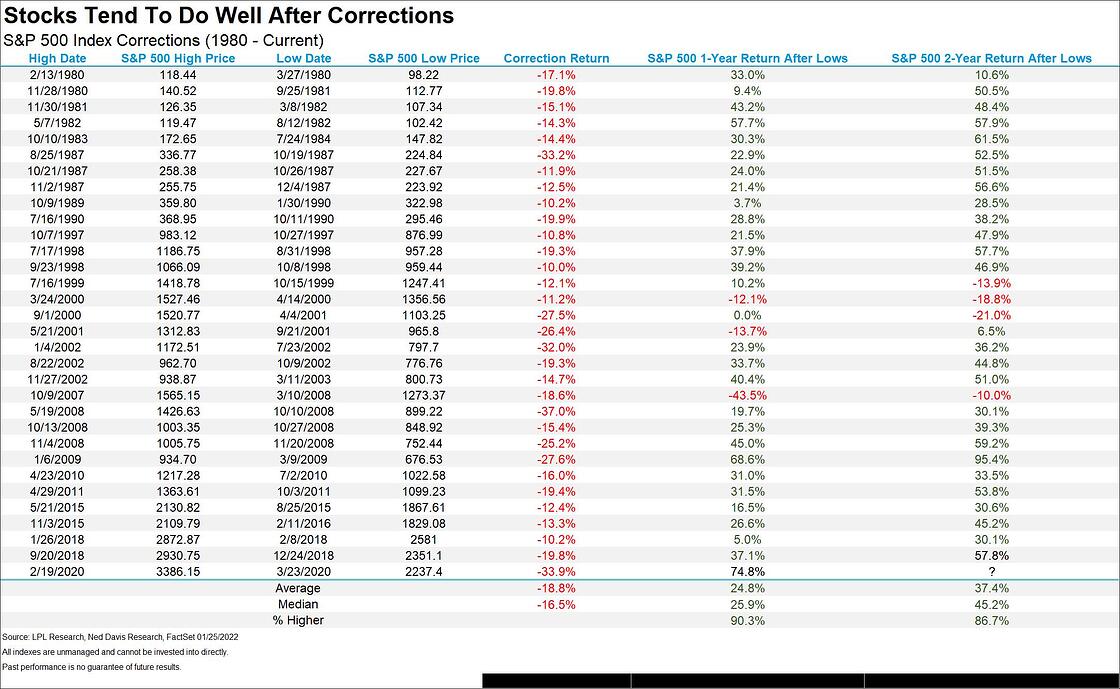

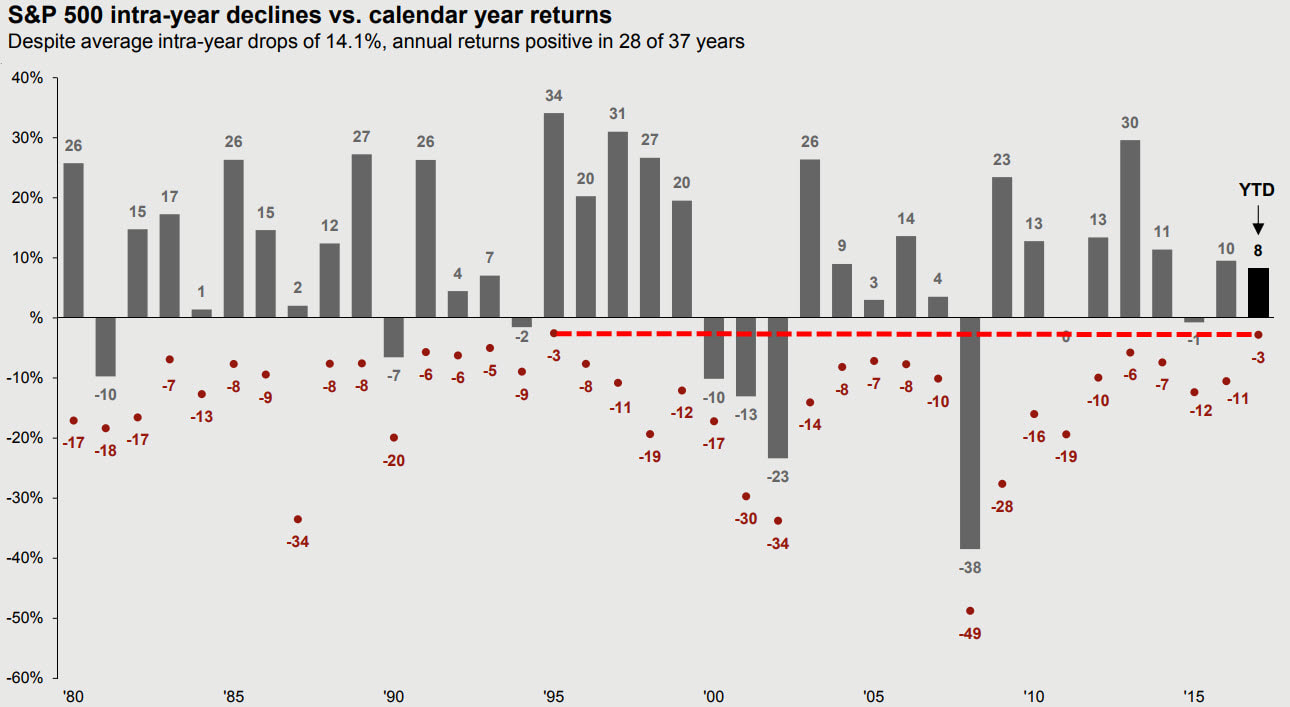

This process is not a perfect science; it takes many years of market experience to handle this type of management. Although the outline of steps is there, the actual test is the behavioral portion of the activity. Understanding the rubber band equilibrium and consistently looking for opportunities helps. Every dollar of cash or protected assets becomes tremendously valuable. If that dollar only went down 7% and is used to buy an investment that went down 40%, you can experience upside leverage. If that stock goes down 40% and it revisits the high price over the next few years, it will have an overall gain of 67%: same company, same price just after a dip. Dips are common and help the market seek higher levels as prices can not just rise straight up. Generally each year brings on a dip of around 5-14%, and every 3-4 years, we get one between 15-20%. Significant drops are less likely but occur every seven or so years but are still random. These are the times when we make our long-term gains, buying entry points that show a much lower risk, much higher reward as the rubber band is stretched too low and needs to come back to center. The band always will, and in between, we will take advantage of the fear that pushes things too low and the greed that stretches things too high to give you an edge. See chart below, as it shows how the rubber band snaps back well after being pulled down. We are tracking this market very closely; we are in an excellent position, and opportunities are starting to become more attractive, but there may be more to fall before they look great. We are patient, continuously reducing risks as we break and waiting for suitable entries into great investments that only come every handful of years.

John R. Oliver- Director of Asset Management One of the 50 notifications I received stood out to me as I woke up today. Ford Motor, to double F-150 lightning (Their electric truck) production again to an estimated 150,000 units. Fittingly this was one day before Tesla, the worlds leading Electric vehicle (EV) maker, announced record car deliveries for the 4th quarter of 2021, over 300,000.

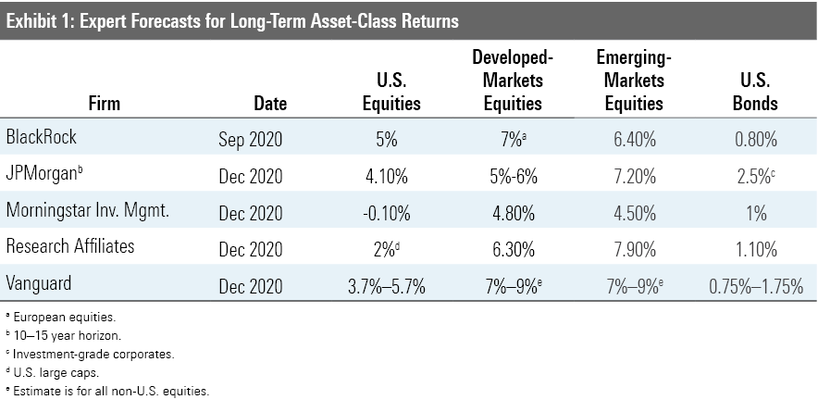

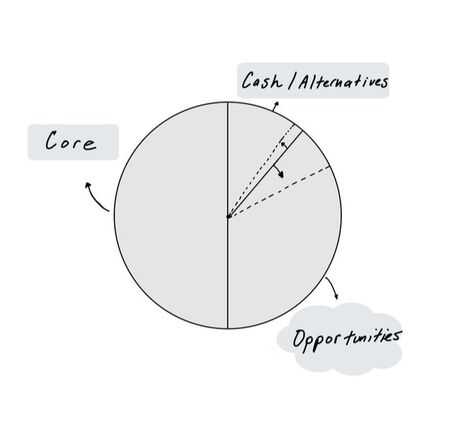

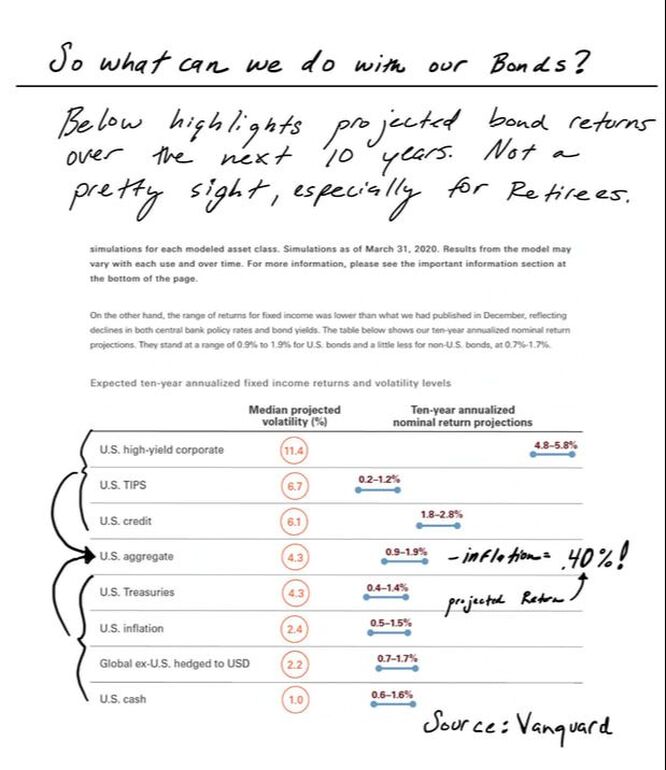

The writing is on the wall. It's here and this time it won't fade. The problem has always been finding a balance of supply and demand, or should I say, supply-demand and hype/excitement. The movement isn't new; I've been following Tesla for over ten years; they were the soldier that battled through the system to make a day like today possible, at least in 2022, not 2032 or beyond. After connecting the dots, data points, and events, I finally conclude that the movement is real. It's here and won't be stopped. I could deny one of those statements many times before, and now I can no longer do so. So what does all this mean? It allows us and other investors to get more constructive on the theme of Green energy and EVs. Spend more time researching and constructing a list of leaders and track them closely. We see billionaires and politicians applying funds in this space. More Investment firms will be investing in the space. These dots discussed above allow us to deepen our conviction on the area. We will continue to increase our time here as the dust is finally settling on a long-term theme that started around 20 years ago and is now finally ripe for investment. John R. Oliver There has been a lot of investment chatter, (Stocks/bonds, Cryptocurrency, SPACs, Inflation) over the last few months as stimulus plans, presidential changes, and the pandemic has created an interesting environment, unlike any other in the past. Below I review my insights on the current climate within the basis of our investment philosophy, some action steps that can help make all this "stuff" matter, and a way to take advantage. STOCKS & BONDS Let's start with a broad look at stock and bond market expectations over the next decade. Some of the top firms did their analysis, and the results are below (updates have looked worse). We could find ten charts that show stocks are overvalued and like a swinging pendulum, need to come back to equilibrium, they always do. Understandably, as the last decade has been exceptional, you should have done well. As overvalued as stocks are, they are a good hedge against the upcoming inflation we are starting to feel, while bonds are more overvalued than stocks on a relative basis. What does this mean for your wealth? If you are using anything over 5% total return before inflation, you may be setting yourself up for some unrealistic expectations. (More on this below) We are at a high risk low reward position on our pendulum; that being said no one can predict what happens from here. How does using a traditional 60% stock, 40% bond portfolio that pre-retirees are often suggested affecting your returns? If your bond portfolio is up 1.75% (the high side) over the next ten years, then what do your stocks need to increase to get a reasonable return? You will have to earn over 8% on your stocks plus an optimistic 1.75% on your fixed portfolio to keep up with your 5% benchmark. Subtract inflation, and your return is now in the 2.5 to 3% range. Let's discuss inflation. INFLATION Multiple factors such as worker shortage, supply shortages then sprinkle on about 8 trillion dollars of liquidity, and we have created a supply and demand mismatch. This supply shortage has created inflated prices on things people want, from cars (metal) to homes (wood). Additionally, poor logistics and high delivery demand within many industries inflate other commonly needed items such as fuel and food. Considering, I still think we can find an equilibrium and weather some of this inflation, we need to be sure that it doesn't spike too fast and investors don't think that the fed doesn't have a good handle on it. Remember, if factors act in unison, employment, wage increases, price increases, then interest rates will need to rise, which will be a sign of health. Some sectors will have a hard time during this period, while others will thrive. Inflated prices can make wealth disappear so be aware and be careful. We still need to meet our goals even if conditions have changed, what can we do? Having a long-term view, an investment plan, the appropriate asset allocation, and a consistent savings program are great things that are needed for success. However, we are currently in an inflated asset price environment. So, does it make sense to do the same thing, or do we adjust accordingly? Model Allocation funds most likely miss the boat here. Suppose projected equity expectations over the next ten years of 5% are true, and you hold a traditional diversified portfolio. In that case, you will miss many strong intra-market trends that take place within markets beyond the traditional asset mix. There are ways you can alter your approach to take advantage of these new trends. An Agile Approach Here are some solutions to keep you engaged and give you a better risk-reward scenario while keeping downside and preservation a focus. CORE Use evidence-based long-term investing in creating a core investment bucket, distinguishing an amount by measuring your risk level and your investment time frame (based on a financial plan). This portion is monitored and managed for investment style, cost, and tax efficiency. The Core portion should not include any short-term cash buckets or fixed income/cash alternatives, just your growth-oriented assets. The asset class mix is consistently upgraded, and it's opportunistically rebalanced based on market rules. The Core will allow you to use investing principles to simplify a portion of your investment plan. To complete the Agile process, you now add your flexible portion of your portfolio, cash/cash alternatives, and opportunities. ALTERNATIVES I've discussed alternatives quite often in the last 12-24 months as bonds have been unfavorable (Bond Alternatives post) , but you still need a preservation bucket in your portfolio. As I mentioned in my post last year, there is a case for a wide array of choices. A few more have entered the arena, namely Special Purpose Acquisition funds, additional choices in the downside protected vehicles, expansion of the crypto world, and another that I will highlight at the end that we just purchased for our clients. Cash and Cash Alternative bucket will be the holding tank for assets to flow into, for example when you rebalance your Core, trim, sell opportunities (more on this in a minute). These assets should not just sit, nor do we NEED to put them in bonds as traditionally thought in the past. Be clever here and look for ideas that have some preservation and safety in mind but still offer some upside potential. Opportunities Opportunities will always exist in markets across all assets. For as efficient as the general market is, if you're curious enough, patient, and willing to work, you can find a disconnect for asset prices and take advantage. It helps if you think of this as an expression of 10-15 drivers (theme, inefficiencies, trends) with 1 or 2 ideas per, resulting in 15 to 20 holdings within the opportunities bucket. Market assets change every minute; no one said you need to be invested in them 100% of the time. Allow yourself the ability to take advantage of fat pitches from time to time while preserving your assets at other times as they sit in your cash alternatives bucket. If we invest in this manner we are investing with the intention of fulfilling these ideas/themes/drivers rather than just filling up the traditional 60/40, 70/30 model. We have introduced competition for our money in which only the best risk reward and asymmetric investments are represented, no more average, no more settling because we think TIME will save us. Does this sound more appealing than the traditional approach? Why is it hard to to do or find someone who can? HARD WORK AND DISCIPLINE It’s hard, it takes hard work and it is often only performed by the ultra wealthy and their teams or those who have the time and discipline to accomplish it, commonly a professional individual trader. Average results come from average strategies, curiosity and persistence need not apply. Most importantly, It takes diligence and emotional stability, it’s one the hardest things to do, some people can, most can't. Emotional discipline... and why is CASH not always bad? When you are managing your investments with discipline, rebalancing, upgrading, trimming and selling cash can quickly build. Why is cash so important to this equation? A hedge is a tool that allows you to preserve your nest egg or counter your risk with the opposite effect of the market. Your cash becomes a Hedge. Generally when you own cash you are hedging against market environments, you are now removed from the market with that portion of money. Cash is emotionless, it has no name, it’s not a brand, or a grand idea, it has no ties and for that cash as they say is king. Over long periods of time cash or cash like fixed holdings can be a poor investment but when it comes to a tactical strategy, cash is a great tool. It allows you to wait on the fat pitch as you are then ready to implement at a moment's notice. It always helps us to be agile when an opportunity comes, we can't predict the future so we wait patiently and ready. So cash is truly the opposite of the market which are controlled by people, their fear and their greed. ACTION

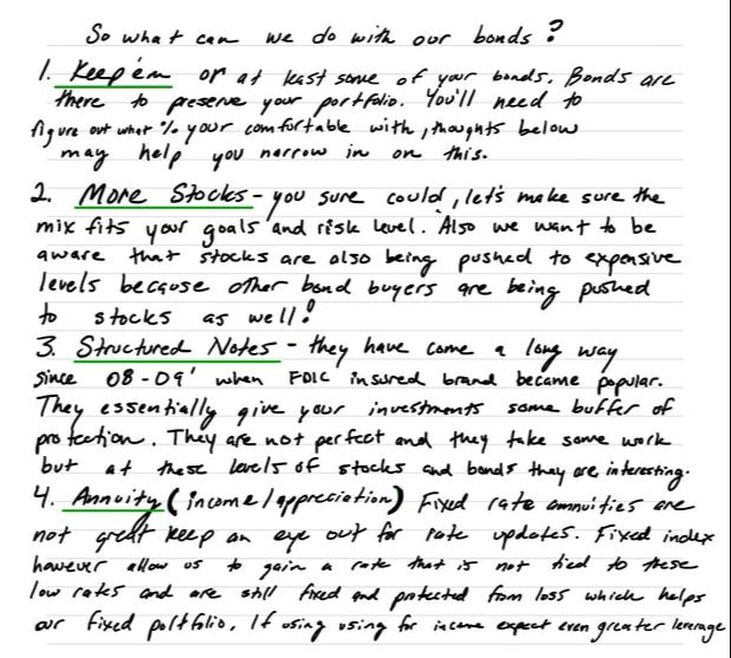

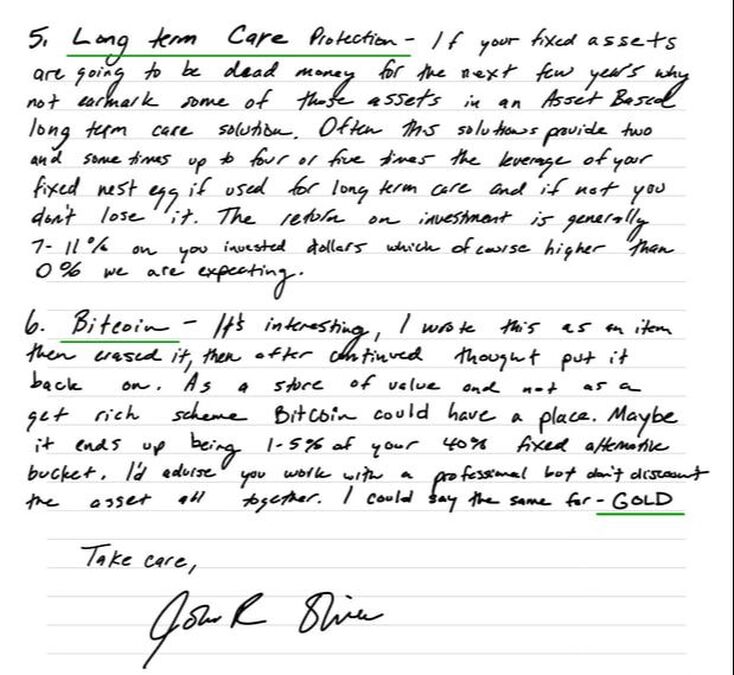

Why can't most people act if we know things are changing and knowing there is an opportunistic agile alternative? As human beings we often wait for the perfect opportunity; downplay the our risk and pressured to follow the herd. It's hard to act. It's hard to gain conviction on what can set us up for success when media and others around us seem to all be on the same path, a path that leads to the status quo. It takes courage and curiosity to think outside the box. We see the best investors do not do what the majority do; they are concentrated in their best ideas, love cash, and their diversification is much different from the rest. We should take note, listen, learn, and do something to make that difference rather than talk and think about it. Create a plan, understand why you're doing what you're doing, and get to work on it. So the next time someone tells you to buy and hold, think a bit about all the factors involved. It's because most of us don't have the patience, curiosity, and willingness to work hard to gain the advantages that present themselves from time to time. It is possible however, You can do it or find a partner who can. - John R. Oliver **Portfolio Investment Update, firm cash alternative bucket. Please understand this is not a direct recommendation as I do not know your current situation, informational purposes only. Many fixed alternatives in themselves could be traded or held for many years and need monitoring. iVol is an innovative fixed income tool; they use their options expertise to create an ideal risk-reward profile that allows investors to get an above-average distribution and protect themselves against credit market volatility and sequentially inflation. No one can predict whether we continue to see inflation lead to higher interest rates. Still, with rates being at 30-year lows, the asymmetric scenario created by this fund allows us to take advantage of a trend reversal that is sure to happen over the next several years. As with anything, if we are unsatisfied or they change the approach, we will not hesitate to eliminate it; for now, we are pleased with this alternative for traditional fixed asset alternative. This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions. Interesting and Intriguing information, I've recently read, watched, or listened to that helps feed my curiosity so why not feed yours. Have a great weekend. I recently traveled to the Upper Peninsula, it was a great experience and the water was refreshing. Afterward, I stumbled upon this article! According to the comments, it's not "Perfect"... but I would have liked to see it before I went, thought I'd share. https://www.onlyinyourstate.com/michigan/weekend-waterfall-itinerary-mi/ Ok, I had no idea of the USPS numbers, so here they are... Consistent Revenue! USPS Income and Expense data for Fiscal Year Ending: 9/30/19, Revenue $71.1B, Expenses $79.9B, Loss $8.8B 9/30/18 Rev $70.6B, Exp $74.4, Loss $3.9B 9/30/17 Rev $69.6B, Exp $72.2, Loss $2.7B 9/30/16 Rev $71.4B, Exp $77.1B, Loss $5.7B 9/30/15 Rev $68.9B, Exp $74B, Loss $5.1B Have you heard of Shopify? Get to know them. Their CEO is Tobi Lutke and it's actually a Canadian company. Youtube interview here, be aware there may have been some expletives. https://www.youtu.be/3Epsahrx1HQ Market tidbits... Apple has added $420 billion to its market cap over the last month, which is more than the current market cap of 493 companies in the S&P 500. $AAPL Should you be considering a Roth Conversion? Take a look at this informative article that may create some clarity before you get knee deep in tax planning... https://www.kiplinger.com/article/retirement/t046-c000-s004-a-great-year-for-a-roth-conversion.html Look out for more of these, they will also live at our Insights section of the Agile Wealth Partners website, for reference. https://www.agilewealthpartners.com/blog So what can we do with our bonds?I wanted to share some notes that I wrote on about the perplexing nature of bonds. Depending on your age you most likely to have little to no bonds in growth stages of life and increasing amounts as you approach retirement. Please understand this is not a recommendation to sell all or any of your bonds without some thought and investigation. Note on 1. There are some areas in the fixed income bond arena we feel comfortable with and will squeak out some gains or at least hold value but not sure that is a solution for all of your fixed assets and they need to be monitored. Two final points, I have ran into some pre retirees with less than say 5 years to retirement over the last several months who had almost 90% in. stocks, it has worked out as we really lucked out again rising back so fast, but if you haven't tactically managed this and you just let it ride up until now consider some of these items below as an alternative to your portfolio. Finally all this can only make sense and come together if you are doing comprehensive planning and making sure everything is working together if not please do not attempt to randomly add one of the items below and think it will just fit. Text version below... So what can we do with our bonds?

I. Keep 'em... at least some of your bonds. Bonds are there to preserve your portfolio. You'll need to figure out what % your comfortable holding, thoughts below may help you narrow in on this. 2. More Stocks-you sure could buy more stocks, let's make sure the mix fits your goals and risk level. Also we want to be aware that stocks are being pushed to expensive levels because other bond buyers are being pushed to stocks as well. Always interesting nooks to be exposed however. 3. Structured Notes-they have come a long way since 08-09' when FDIC insured brand became popular. They essentially give your investments some buffer of protection to the downside and have limitations to upside. They are not perfect and they take some work but at these levels of stocks and bonds they are, interesting. 4. Annuity - Income or appreciation contracts. Fixed rate annuities are not great but keep an eye out for rate updates sometimes companies make decent offers. Fixed index however allow us to participate in gains that is not tied to current low rates and are still fixed/ protected from loss which helps our fixed portfolio. If using using for income expect even greater leverage 5, Long term care Protection- If your fixed assets are going to be dead money for the next few years why not earmark some of those assets in an Asset Based long term care solution. Often this solutions provides two and sometimes up to four or five times the leverage of your fixed nest egg if used for long term care and if not use you don't lose it. The return on investment is generally 7- 11% on you invested dollars which of course higher than we are expecting. 6. Bitcoin- It's interesting, I wrote this as an item then erased it, then after continued thought put it back on. As a store of value and not as a get rich scheme Bitcoin could have a place. Maybe it ends up being l-5% of your 40% fixed bucket. I'd advise you work with a professional but don't discount bitcoin all together. I could say the same for-Gold 96% of Social Security claimants fail to make the optimal claiming decision. That means they lose out on an estimated $3.4 trillion in potential retirement income ($111,000 per household) because they don’t choose the option that maximizes their income.

That’s why it’s so important to get the most accurate and up-to-date information, assess your personal situation properly, and file for Social Security the right way (and at the right time). https://unitedincome.capitalone.com/library/the-retirement-solution-hiding-in-plain-sight 4 Things You Might Not Know About Social Security (1) Your Social Security Benefits may be taxed... https://docs.google.com/presentation/d/14NetqQnHjnuwhaQNBJrSNxofIL8Nfwz5653Xb-SJ-EU/edit#slide=id.p22 (2) You may be able to claim at age 62 on your own SS and switch to spousal benefits later to receive a higher benefit. https://www.aarp.org/retirement/social-security/questions-answers/switch-social-security-spousal/ (3) You can suspend SS benefits and restart them at a higher value later. Maybe you find yourself starting a business or consulting part-time. https://www.aarp.org/retirement/social-security/questions-answers/suspend-social-security-then-restart/ (4) You can use Delayed Retirement Credits to maximize your benefits. For every month from your FRA until age 70 that you postpone filing for benefits, Social Security increases your eventual benefit by two-thirds of 1 percent — a total of 8 percent for each year you wait. For example, wage earners who reach full retirement age at 67 but delay claiming benefits until 70 will get an extra 24 percent tacked on to their monthly payment. https://www.aarp.org/retirement/social-security/questions-answers/delayed-retirement-credits/ (5) BONUS: You may be able to collect SS as a divorced spouse and then wait to claim on your own work history. You can file what Social Security calls a “restricted application” to claim only ex-spousal benefits and postpone claiming your retirement benefits if: You were born before Jan. 2, 1954. You have reached full retirement age (currently 66, gradually rising to 67 over the next several years). You were married for at least 10 years to your former spouse. You are currently unmarried. Your former spouse has filed for his or her own Social Security benefits or your ex-spouse is at least 62 and you have been divorced at least two years. https://www.aarp.org/retirement/social-security/questions-answers/claim-divorced-spouse-benefit/ WHAT SHOULD YOU DO NEXT? Create your own online SS account https://www.ssa.gov/site/signin/en/ REQUEST Free No Obligation SS Planning Tool OTHER ARTICLES/RESOURCES Thinking of retiring? https://www.ssa.gov/osss/prd/pdf/en/55-plus-insert.pdf COLA raise likely for 2021 -- Kiplinger forecasting 1.2% https://www.kiplinger.com/retirement/social-security/601286/2021-cola-a-raise-likely-for-social-security-recipients-after-all?rid=EML-retire&rmrecid=4628004169&utm_campaign=20200902-retire&utm_medium=email&utm_source=retire Steve Livingway

Did the Market just give us a gift?I wanted to share a video that illustrates what I was saying back in February. In my post here, about bonds, I was discussing the importance of changing your allocation and taking advantage of trends based on what the market is giving you. Once you enter retirement you may be relying on Stocks more than you think to achieve your desired income as interest rates are low and may be stuck lower for longer.

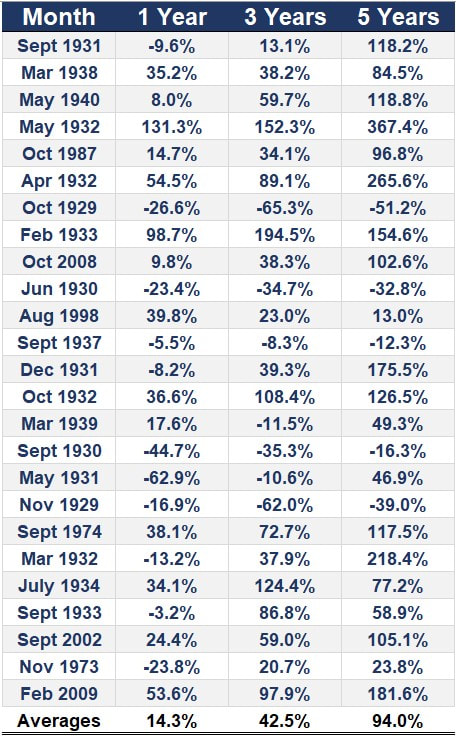

At that time, the market was one day from all-time highs and, I had suggested being ready for what may come; however as you all know I do not predict what the market does next. Although it looked obvious the market was going to get tired and that bonds were showing us some underlying fear, in reality, a virus ultimately was its undoing in the end. If I told you that we could go back in time and sell that day we would all take that gift. As I write this today, maybe you have not looked... The SP500 Index, my choice guide, is only 14% from the February highs! This is surely surprising as we have shut down most of the country for over 2 months and things will be slow to recover. So where does this leave us? As I said above I don't predict, and I will still allow assets and trends to guide us; however, I am not very comfortable here and suggest starting or investigating these actions listed below. With market returns projected to be on the lower end of historic averages and bonds yielding near nothing, we need to realize we are in for a different retirement plan than many of us originally had. We need to consider the following: - Opportunistic rebalancing - Creating fixed income streams - Use alternative tools such as structured notes - Adjust portfolio with lower volatility holdings - Decide what your core portfolio percentage is (The long term Core holdings you will not touch) The video below suggests how devastating retirement portfolio dips can be; therefore, it is very important to plan for such occurrences as you will most likely experience a handful in a 30-year retirement. Most importantly when they happen is a factor that can change your retirement trajectory forever. I wish everyone well and hope you and your family are staying positive and healthy. Take care. John  I'm think you're probably saying... yes John I care what should I do!? Ultimately I care, of course, at the same time however I am truly looking at this as a long term opportunity than a long term crisis. I am not completely comfortable on how this will all end nor do I care to predict as I said in my last piece, Bonds at all-time highs, however, history has shown 20%+ sell offs are rare and 30% drops are even rarer. Here is a chart that shows the draw-downs we have experienced and the ending market return for that year. The key here is to see that there are not many market drops over 20% and when there are it is often an opportunity at some point around that drop. Another takeaway market drops are not substantial until they hit 12%. We have to look out a bit to when the Coronavirus slows and we feel we have good control over things, more importantly, the travel and business that continues to get canceled is no longer being canceled. At that time we will be sitting on free money, 10yr bond under .50%, cheap energy as oil is selling off as well, and fair market valuations. Sure all this may need some time to get sorted out but in the meantime work with your advisor or shoot me a call/email to take a second look because if we approach this correctly there is a huge opportunity here. If you are in the first few years of your retirement please seek advice as that would be the time frame which I am the most concerned. As you can see below, we often are higher after sell-offs like these. Below highlights months where we experienced the largest sell-offs and the subsequent return after in 1, 3 and 5 years. (bottom) As we can see time is the key factor here, so in the meantime, we should be doing a few things in our financial plans.

Be well, John  As you may be reading or watching on the news, we are starting to see some cracks in the armor of this market, more on this later. Most importantly rather than focusing on all the negativity and stories surrounding the markets today along with all the political garbage going on I wanted to point out some actual news that should be making us take action or at the least getting a game plan together. Bonds are at all time highs and don't really have much room to go up as the 10 years is sitting at sub 1.5%, couple this with markets being just under their all time highs! See above... As you can see the yellow line above shows a path that would take the 10 yr to 0% which has very low probability of happening. If this were to be the case your bond would increase roughly 4-5% and would yield 0%. Most studies show your projected rate of return on your core risk free bonds at the moment is the yield it currently is earning. So look to earn 1.5% on your bonds over the next few years which puts real returns into the negative. So what does this mean, we have a defined risk asset and a high probability outcome ahead of us. In some views it's worry and fear that dominate the conversation. In my eyes it's opportunity, here are some of the outcomes that stem from this situation:

As for the market, yes this signals some flight to safety and may be start of something larger but if you are in good position tactically just be aware of the idea that a small sell off could become larger and be ready. Don't try to predict just have a game plan on what you would do if stocks went down over 10%. It's not about predicting more than it is about knowing your plan when and if something does change. I'll assume most of us have more to do than worry about the market like, creating strategic allocation, Core allocation minimums and planning around what is actually happening NOW...Bonds are at all time highs and it's an opportunity! PS Go talk to your bankers and mortgage reps to see if you can't lower some of your rates on debt! |

The Agile Investor is a blog that focuses on being prepared and informed within various topics of wealth management, investments, financial markets and investor psychology. Enjoy Archives

May 2022

Categories |

Proudly powered by Weebly